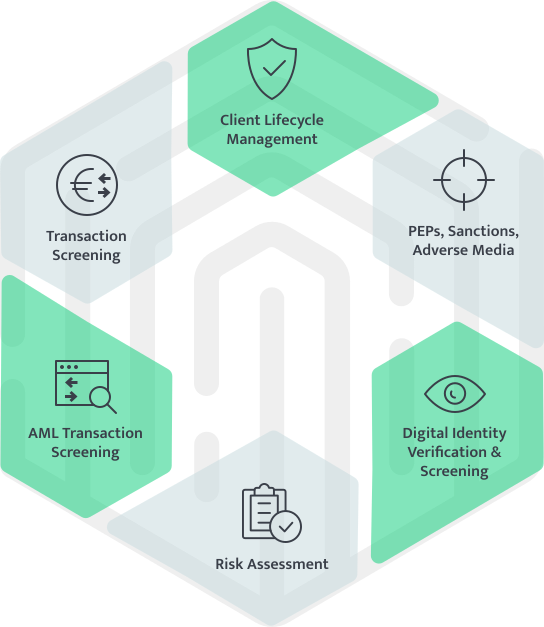

AML screening

Watchlists, International Sanctions lists, PEP screening, Adverse Media checks, Ongoing Monitoring and much more.

Learn MoreCONDUCT KYC/AML QUICKLY, PROPERLY AND STRESS-FREE.

Book a Demo

scroll down

Watchlists, International Sanctions lists, PEP screening, Adverse Media checks, Ongoing Monitoring and much more.

Learn More

An AI- powered digital onboarding solution for remote identity verification. Take advantage of an iBeta accredited, fully-passive liveness tool.

Learn More

Our Selfie vs ID face match benefits from industry-leading accuracy. Benefit from data extraction and validation in a comprehensive variety of scripts and languages. ID document OCR with support for 190 countries.

Learn More

Stay compliant with regulatory requirements with our ongoing fiat transaction monitoring solution.

Learn Moreyears combined experience in AML

Countries covered

Satisfied clients

checks daily

We are very proud to say that we have worked with specialists from across the globe in developing a simple and straight-forward AI solution. Our solution scans and aggregates data from various sources daily, offering latest information on PEPs, sanctioned persons, international terrorists and global adverse media by country.

We understand the complex nature of Banks and other Financial Institutions. That’s why we’re able to simplify their processes by revolutionising compliance and automating onboarding.

Finchecker assists Investment firms in tackling key client compliance challenges through automation.

Trusted by world-leading forex brokers, Finchecker assists its clients in automating their compliance processes, while staying up-to-date with the latest global regulations through machine learning and BI-Analytics driven solutions.

Learn More

We specialise in helping payment firms onboard applicants effectively with instant global compliance by utilising hundreds of KYC data sources.

Learn More

Finchecker has been selected by several Insurance firms to deliver their onboarding processes and address fraud and financial crime obligations that occur in the sector.

Learn More

Finchecker fully understands the challenges observed by gaming and gambling firms; they face both AML and KYC obligations. For that reason, our RegTek+ solution helps them comply, while reducing costs and increasing productivity.

Learn MoreAll the tools you need for AML & KYC compliance are offered in a neat-and-tidy API. No more switching between solutions, no more stress.

The quick-to-integrate API can be applied and shaped to any use case. Whether you need fiat transaction monitoring or ongoing adverse media checks, our solution moulds to your back like a bespoke jacket.

At Finchecker, we pride ourselves on the support we offer to our clients. Indeed, unlike many of our competitors, integration support is in-house, and each of our solution architects knows the product inside out.

As we only offer our clients proprietary products, we remain competitive as one of the lowest-priced solutions on the market.

Many provide limited datasets, resulting in confusion, regulatory fines, delays and ultimately, fraud.

Many flows have been pre-constructed in a one-size-fits-all SDK. Corners are cut and clients are lost.

Integration is perpetually just ‘a few weeks away’.

The list of extras goes on and on, with often extortionate integration fees hidden between the lines.

As we welcome 2025, we’re thrilled to announce we are going to be in ICE Barcelona, taking place from January 20th to 22nd!

The Finchecker team will take part in the iGB L!VE conference in Amsterdam from July 16 to 19!